Carbon Offsetting Lifecycle

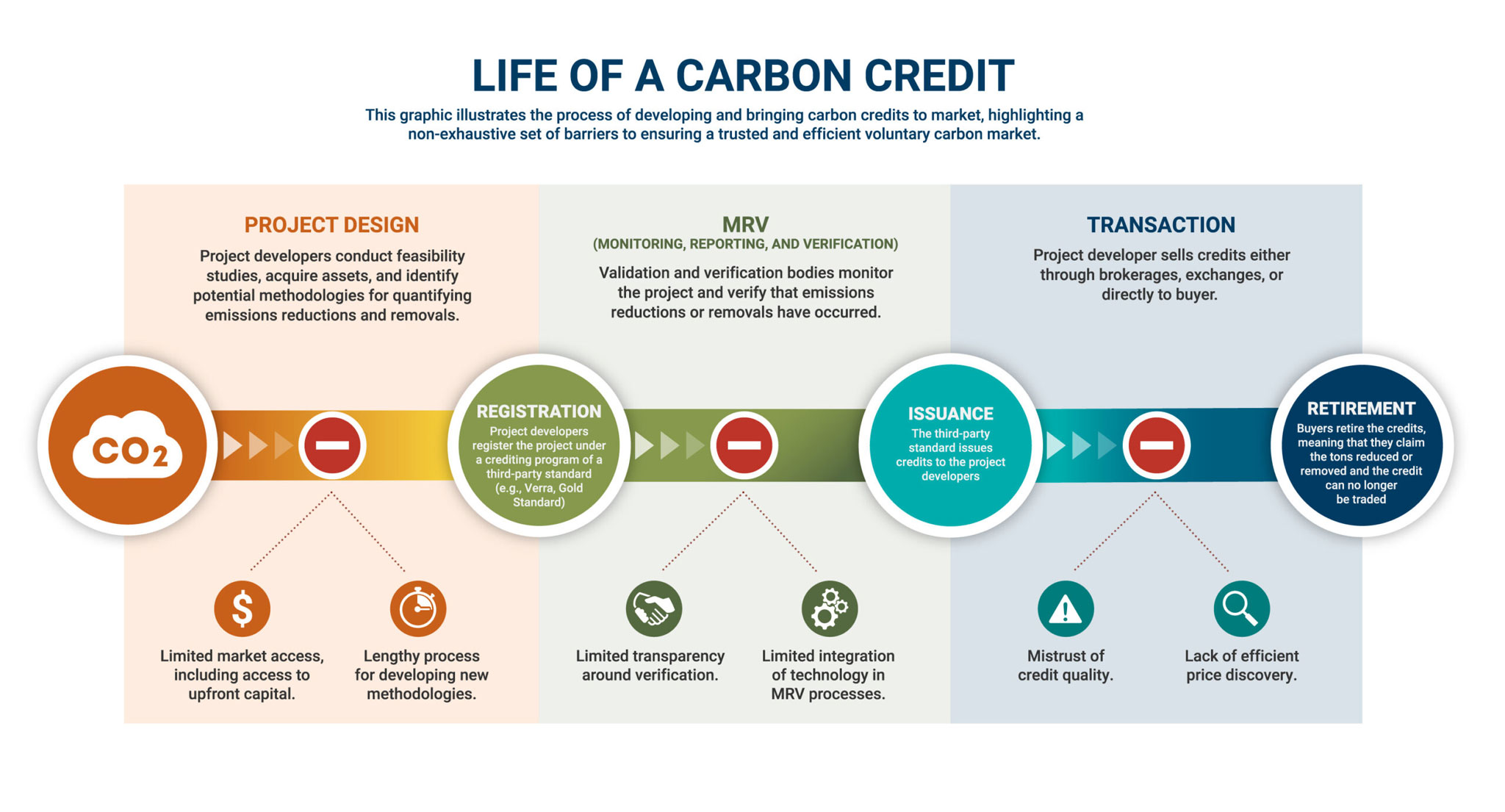

Project Planning Phase

Each climate project has a defined life cycle. The project developer reviews the general feasibility of the project, project design and financing. A Project Design Document is prepared, which contains the basic information about the project. Ex: the project objective, location, implementation date, and duration.

Validation

The Project Design Document and the information it contains are validated through independent audits. The accredited, neutral auditors must be approved by the standard’s registry as a Validation and Verification Body.

Registration

After a successful validation, the project can be registered with the standard, such as the Verified Carbon Standard or the Gold Standard.

Monitoring

After the project has been registered, it is time for the monitoring phase. The project developers monitor and record the data of the project activities and its progress. Duration of the monitoring phase varies with each project, which can be one to five years.

Verification

When the monitoring phase ends, a validation/verification body checks and assesses whether the values and project activities stated in the monitoring report are correct and verifies them.

Issuance of Verified Emission Reductions

The emission reductions achieved in the latest monitoring period can be issued ex-post as verified emission reductions after successful verification. They represent the emission savings that indeed took place in the past period. This can take one to five years.

The steps of monitoring, project verification and issuance of verified emission reductions are repeated regularly and are thus to be considered as a cycle.

Retirement of Verified Emission Reductions

After a verified emission reduction has been used to offset emissions, it is required to be retired in the respective registry (e.g., Gold Standard, Verra etc.). Ensuring that each verified emission reduction is used only once. When an offset is booked via Carbon Free Zone the verified emission reductions are collectively retired periodically.